Sunshine Corner 10/2024

This month, let's get into jobs, my repro rights roadshow, and commercial real estate.

Jobs, Jobless Claims, and Fed Minutes

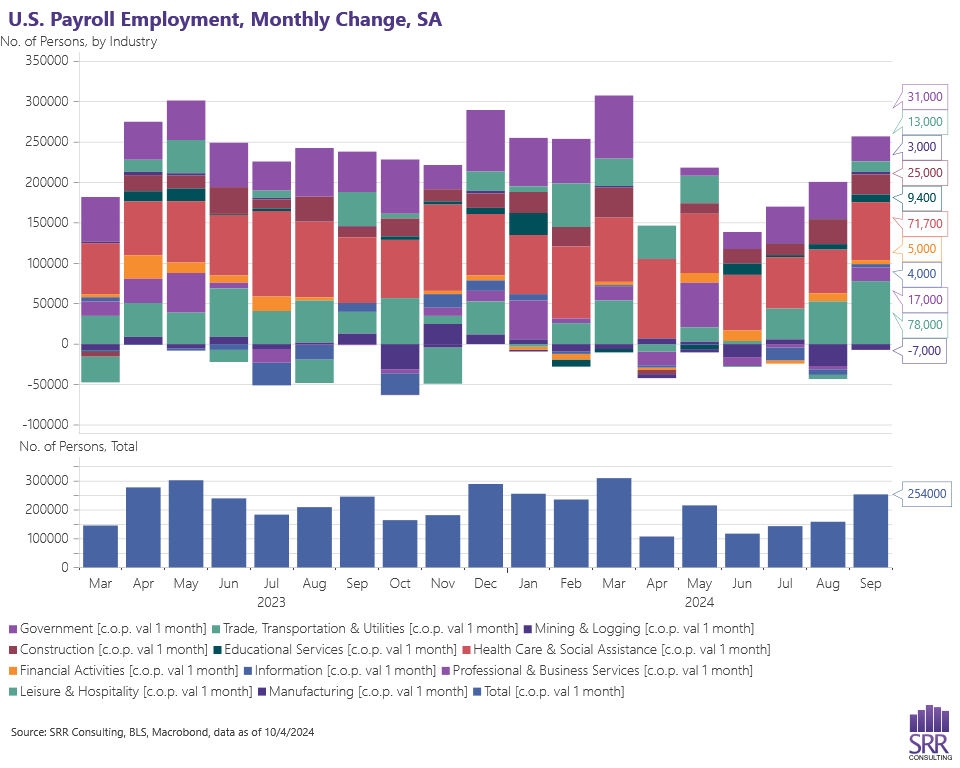

The job market is the gift that keeps on giving. Payroll employment jumped in September with 254,000 new jobs added in the month, for a total of 1.8 million new jobs added to-date in 2024.

Across the major industry sectors, all but manufacturing added jobs over the month. Health care and leisure/hospitality added the most jobs over the month, accounting for 59% of the total, or 149,700 jobs.

The BLS payroll employment survey counts the jobs people hold, while the household survey counts people in the labor force who are employed or unemployed.

The household survey revealed a marginal decline in the unemployment rate — down to 4.1% in September from 4.2% last month. While the unemployment rate is higher than 3.8% a year ago, the current 35-month streak of sub-4.5% unemployment rates reflects the strongest U.S. labor market conditions since the late 1960s.

It is against this backdrop that the Fed moved to lower the benchmark federal funds rate by 50-basis points (bps) in September to a range of 4.75%-5%. The Daily Show’s interpretation of the Fed’s actions really nails the vibe:

I was prepared to see a 25-bps cut last month due to caution on re-igniting inflation. My concerns on inflation are tied to rising geopolitical tensions that risk higher oil prices and supply chain disruptions, the costs of climate change, and the potential to fuel further real estate rent/value increases with rate cuts.

The Fed’s meeting minutes show broader discussion on the 25- versus 50-bps than was evident by the single dissenting vote. The decision came down to not risking further labor market deterioration by keeping monetary policy too restrictive. Can’t argue with that.

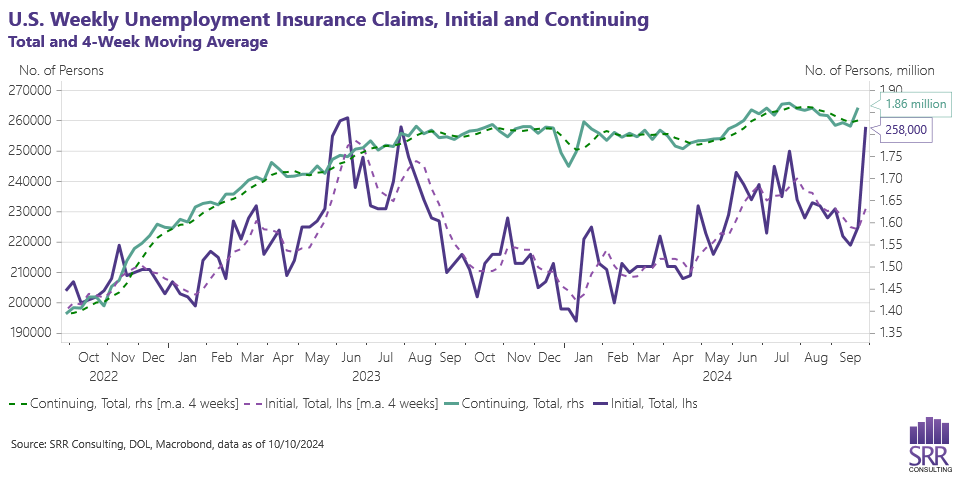

Weekly unemployment insurance claims after the Fed’s rate cut went in the wrong direction — sharply higher. This weekly data can be noisy and there has been considerable noise in September and early October.

Hurricanes Francine, Helene, and Milton made landfall in September. Helene was a major hurricane leaving behind considerable damage far from the coast in western North Carolina and eastern Tennessee. Damages and disruptions from these storms are driving unemployment insurance claims higher in impacted areas.

Labor strikes are another factor influencing unemployment claims. In September, the BLS reports that nine work stoppages were in effect, impacting 82,600 workers. The Boeing strike on the west coast and the national hotel workers’ strike account for 70% of impacted workers.

These temporary factors will fade over time and, in the case of hurricane damage, could be offset with the employment needs for the recovery. As a result, the recent jump in jobless claims is unlikely to be a sign of deteriorating demand for labor.

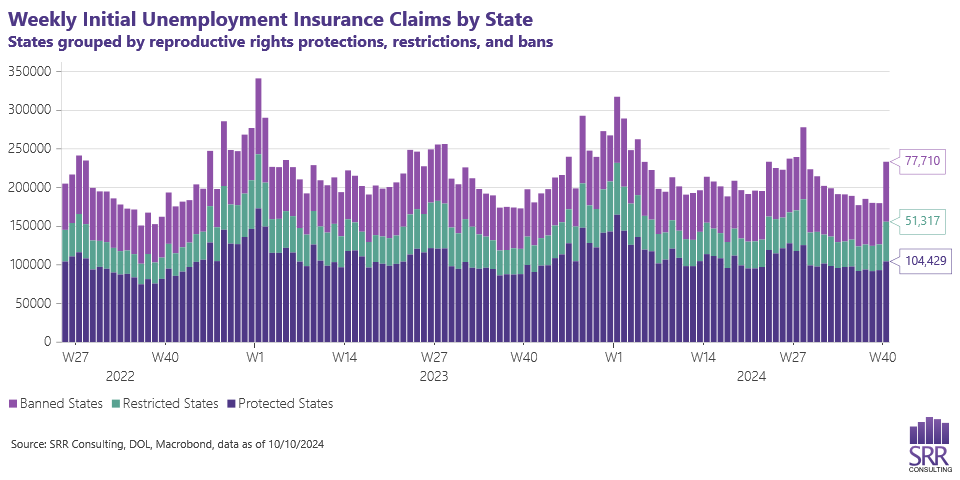

Fun Fact: Four-week average Banned state unemployment insurance claims are up 27% year-over-year through October 5, compared to 5% in Protected states.

Repro Rights Roadshow

Thirty months have passed since the Dobbs decision, and I am tired. The negative economic consequences of criminalizing healthcare are obvious, but talking about it isn’t popular. Yet.

Dobbs was a “black swan” event. Unexpected and unknowable. Upending 50 years — generations — of settled law. For economists and investors, forecasts and pro formas based on the pre-Dobbs status quo will miss the mark.

I attended the NABE Annual Meeting in Nashville to moderate the commercial real estate panel and host a dinner discussion. We had great turnout for our session, “How Technology and Geopolitics are Driving Shifts in Manufacturing, Supply Chains, and Industrial CRE”, assisted by placement immediately following Fed Chair Powell’s luncheon address.

I was surprised not to hear reproductive rights raised in the labor market sessions, particularly the one titled, “Shifting Labor Market Dynamics”. Since our ability to participate in the labor market and plan a career goes out the window without bodily autonomy, this topic belongs in any discussion of U.S. labor market trends.

Fun Fact: The U.S. has the highest maternal mortality rate, at 22 deaths per 100,000 live births overall, and a horrific rate of 50 for Black Americans. The next-highest rate among wealthy nations is 14 in Chile and the lowest is 0 in Norway.

I was able to raise the issue in a conversational session titled, “Economic Issues Forum: What’s keeping you up at night?”. I quickly ran through the problem, inevitable consequences, and my latest work.

The reception in the room felt different this time. I received more engagement and, in individual conversations, found interest in data sharing. Hooray! My rocking repro rights roadshow has been trucking around long enough to get attention.

As others offer me cups of data, I look forward to running them through my state filters for protected, restricted, and banned reproductive rights. Some early work with multifamily data from Yardi Matrix yielded the following on occupancy rates:

Fun Fact: Banned state multifamily occupancy declined by 20 bps, to 93.9% between June 2020 and August 2024, while protected state occupancy increased 20 bps to 96.2%.

Private Real Estate Performance Primer

I produce a quarterly report on private equity real estate performance as part of my independent research services business, SRR Consulting. The data used for this analysis is sourced from NCREIF, which I know is not a familiar resource to those outside my field.

A primer on this data — what it is and where it comes from — using return highlights from Q2-2024 will close out the Corner this month. The Q3-2024 data is due out next week and, with interest rate easing underway, there will be interesting trends to cover in the coming quarters.

This adorable, bespectacled puppy encourages you to keep reading despite the wonkiness ahead.

Don’t let the puppy down. Learn about NCREIF instead. If you already use NCREIF data, there is a special treat for you at the end.

Keep reading with a 7-day free trial

Subscribe to Sara's Fun Facts to keep reading this post and get 7 days of free access to the full post archives.